How will GST affect the car prices in India? Will they become cheaper or expensive after 1st July 2017? Here is everything you need to know!

The Goods & Service Tax (GST) is all set to be implemented in the country starting 1st of July 2017. This simplified taxation system is one of the most important steps taken by the Government of India to strengthen the Indian economy. With the implementation of GST, the Government aims to replace the multiple state and central taxes with one single tax structure across India. As a result, every business sector operating in India is going to have some sort of impact after the GST implementation.

GST & the Indian Car Industry

The Indian automobile industry is also going to have a major impact after the implementation of the Goods and Services Tax or GST. However, it must be noted that the impact won’t be same across all car segments. The impact in the form of price change will affect every car segment differently. Not only cars, but the GST implementation will affect two-wheeler segment as well.

Will the prices increase or decrease?

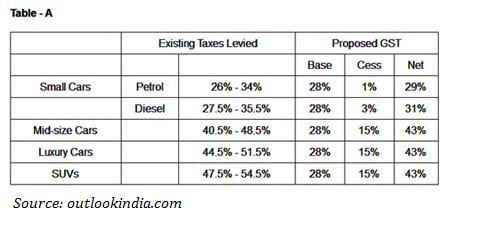

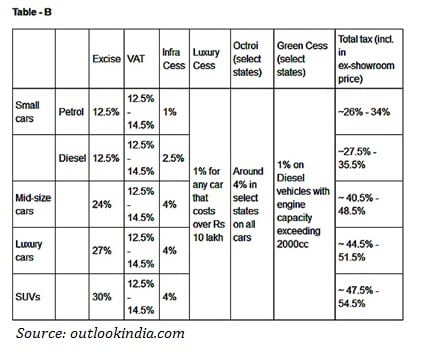

After the implementation of GST, a unified tax structure will be applicable on cars. This means that the ex-showroom prices of any particular car will be same across the country. However, since road taxes and registration taxes varies across states, the on-road price will still won’t be same across the country. The prices though will have a change. Let’s have a look at the impact and price changes across the car segments in India post GST implementation.

Changes across the Car Segments

The current classification of cars is broadly divided into four categories or segments:

Small Cars

The cars under four-metre length and a petrol engine not more than 1200cc or a diesel engine not more than 1500cc fall under this segment. These may include small hatchbacks, compact sedans and compact SUVs as well. The small cars have been kept under the 28% GST slab, and an additional 1% cess on Petrol cars and 3% on Diesel cars will be applicable. This suggests that there will be a little increase in the prices of small cars. Also, the difference of prices between petrol and diesel variants will also increase.

However, the Finance Minister Arun Jaitley has recently confirmed in an interview that the price of small cars will remain more or less the same before and after implementation of GST taxes.

Mid-Size Cars

The cars over four-metre length and not powered by a petrol or diesel engine over 1500cc fall in the mid-size car segment.

The mid-sized segment with cars like Maruti Suzuki Ciaz and Honda City won’t be affected a lot. After the GST implementation, the mid-sized car segment is the only car category that won’t see any changes. The prices will remain almost the same. However, it must be noted that the mid-sized cars with hybrid technologies are going to be expensive since the GST on hybrid cars will remain the same as of petrol/diesel cars. Hybrid cars currently enjoy excise duty of 12.5% instead of 24% or 27%. But post GST implementation, things will change and cars like Maruti Ciaz SHVS will get expensive.

Luxury Cars

The cars over four-metre length with a petrol or diesel engine over 1500cc fall in the luxury car segment.

Currently, the luxury car segment is taxed between 47.5% to 54.5%. However, after GST implementation the luxury car segment will also fall under 28% GST slab. An additional 15% cess is applicable to ensure that the government doesn’t face loss in the tax revenue from the luxury car segment. Adding together, the 43% (28% + 15%) tax suggests that the price of luxury cars will fall after GST implementation. This comes as a good news to all those planning to buy a luxury car soon.

SUVs

The cars over four-metre length, 179mm ground clearance with a diesel or petrol engine over 1500cc fall in the SUV car category.

Currently, the SUV car segment is taxed between 47.5% to 54.5%. And post GST implementation, it will also fall under the 28% GST slab like the luxury cars. An additional 15% cess will make it 43% on the SUV cars after GST. This means that SUV cars will become cheaper when the taxes will decrease by close to 10%. Don’t get shocked if SUVs like Toyota Fortuner will get a decrease in price over Rs.1 lakh. If you are planning to buy an SUV, wait for the month of July to arrive.

Do share your thoughts and comments on the Goods and Service Taxes implementation and its impact on the Indian car industry in the comment section below. We will wait for your take on the changing taxation system.